Rate Related Update and Market Conditions

European routes struggle to maintain prices; the cargo rush effect before the Spring Festival is expected to weaken relatively

European routes face rate struggles as pre-Spring Festival cargo rush weakens due to the Red Sea crisis. Mexico cracks down on illegal imports, aligning with U.S. trade policies. High tariffs increase pressure on retailers and low-income households. Intense competition on India-US East Coast routes drives rate cuts, while Gaza ceasefire talks continue amid disputes over Hamas’s future role.

Gemini Cooperation: Booking Opens Starting on December 3rd 2024

Hapag-Lloyd announced that booking windows for the “Gemini Cooperation” network open on December 3, 2024, with February 2025 updates to follow. Part of its “2030 Strategy,” the partnership with Maersk aims for 90% schedule reliability, covering 59 routes with 340 vessels and 3.7 million TEU. Due to Red Sea instability, routes are being rerouted via the Cape of Good Hope, with operations starting February 2025.

Maersk Places Another Major Order for 20 Container Ships

On December 2, 2024, Maersk confirmed an order for 20 LNG dual-fuel ships totaling 300,000 TEU, completing its 2024 fleet renewal target. Ships will be built by Yangzi Jiang, Hanwha Ocean, and New Times Shipbuilding, with deliveries from 2028 to 2030. Maersk also plans to lease 500,000 TEU methanol and LPG dual-fuel ships, adding to its fleet of 720 ships with 4.43 million TEU capacity.

Brazil Nationwide Indefinite Strike! Import and Export Customs Clearance Disrupted

On November 25, 2024, Brazilian customs auditors began a nationwide strike over salary disputes, disrupting port and airport operations. The strike has delayed cargo clearance, increased logistics costs, and caused severe congestion, particularly at Santos Port, which handles 30% of Brazil’s trade. Exporters face risks to holiday shipments, with some resorting to costly air freight. Experts urge swift government action to stabilize foreign trade.

COSCO Group Launches Far East to South America West Coast Route

COSCO’s Chancay Port in Peru began trial operations, with “COSCO TENGFEI” launching a direct Far East-South America West Coast route, carrying 2,756 cars from Shanghai. This monthly service includes stops in Peru, Chile, Colombia, and Ecuador. COSCO’s fourth regular route enhances vehicle transport efficiency, supported by Yuan Hai Car Carrier’s value-added services and a developing multimodal network for South America.

MSC Plans to Enhance East-West Service Network, Effective February Next Year

MSC announced East-West network upgrades effective February 2025, enhancing Asia-Europe, Asia-North America, and Asia-North Europe connections. Key changes include new port calls in Vietnam, Nansha, Vizhinjam, Colombo, and London Gateway. Notable updates include Mustang service integration and expanded stops for Pearl, Chinook, and Britannia services. These changes improve connectivity without affecting tonnage or deployment on other routes.

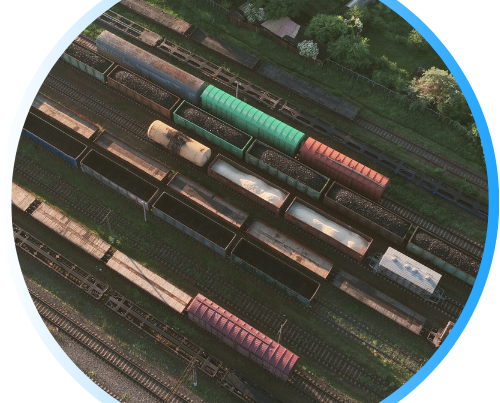

Port Congestion

Smaller Carriers’ Slot Deals Pressure India-US Freight Rates

The India-US East Coast shipping market faces reduced rates as smaller carriers secure slot agreements to maintain market share. Freight forwarders report that major players, such as Cosco and OOCL, have adjusted strategies following network changes related to the Gemini alliance. These dynamics are increasing competition, particularly on the Nhava Sheva to New York route, where spot rates have dipped to $1,800 per FEU. The expanded capacity pressures existing carriers while reshaping trade lane economics.

Schedule Reliability Challenges Persist in China-Europe Rail Corridor

Rail freight connecting China and Europe struggles with consistent schedule reliability, impacting customer trust. At the European Silk Road Summit, experts highlighted that delays on the middle corridor remain a top issue. E-commerce shippers find express services to Poland’s Malaszewicze hub appealing despite reliability challenges. Industry leaders stress that maintaining punctuality is critical for rail freight to compete with sea transport, especially when disruptions occur.

Panama Canal Proposes Massive Dam to Combat Climate Challenges

The Panama Canal Authority plans a $1.6 billion Rio Indio reservoir to address droughts and secure water for operations and local needs. The project requires the relocation of over 2,000 residents, prompting mixed reactions. The initiative, critical to global trade and Panama’s economy, must navigate public concerns, environmental impacts, and approval processes. Expected by 2030, the dam would enable additional vessel transits and support the canal’s sustainability amid escalating climate challenges.

Protesters Blockade Access to Georgia’s Key Black Sea Port

Anti-government demonstrators in Georgia obstructed access to the Poti port, the country’s main commercial hub handling 80% of container traffic. The protests followed the government’s decision to delay European Union membership talks by four years. Poti port, operated by APM Terminals, has faced disruptions as activists demand political reforms. The full extent of the blockade’s impact remains unclear, though it underscores tensions surrounding Georgia’s EU integration prospects.