Rate Related Update and Market Conditions

-

Market Conditions

TPEB (Trans-Pacific Eastbound)

-

TPEB demand remains strong overall, supported by concerns over potential tariff changes later this summer and the approaching peak season. However, a slowdown in booking activity has been observed since early June. While West Coast rates continue to decline and the GRI scheduled for June 15 has been withdrawn, East and Gulf Coast rates remain stable, with GRI and PSS still in place for those lanes.

FEWB (Far East Westbound)

-

FEWB demand is exceptionally high, with most vessels fully booked and some cargo already rolling. A sustained rise in the Shanghai Containerized Freight Index has prompted carriers to maintain high rates, with new GRIs planned for late June. Despite rate hikes, bookings are rising, fueled by early planning for July exports and ongoing concerns about capacity availability.

TAWB (Trans-Atlantic Westbound)

-

TAWB rates are steady for now, though most carriers have delayed PSS implementation until July. While the market expected stronger demand following previous disruptions, actual volume recovery remains inconsistent. East Mediterranean routes are seeing the longest delays in surcharge rollouts, while some West Mediterranean carriers are still considering surcharges later this month.

Operational Updates

TPEB:

-

Equipment availability across Asia remains sufficient, and origin ports are operating without major delays. Container flow is stable, and there are currently no widespread disruptions impacting turnaround time or inventory flow.

FEWB:

-

Severe congestion continues at major European hubs like Rotterdam and Hamburg, with vessel bunching and labor shortages causing berthing delays of up to one week. These delays are putting pressure on operations and causing ripple effects across the network.

TAWB:

-

Inland regions of Central and Eastern Europe continue to face container shortages, particularly in Austria, Switzerland, Hungary, and Slovakia. Most coastal ports are stable, but carrier haulage is advised to support smoother equipment availability for inland origins.

Capacity Management

TPEB:

-

Carriers have restored more capacity this month, particularly through extra loader deployments to West Coast ports. Offered capacity for Week 24 is 5% below standard but is expected to exceed standard by 4% next week. Blank sailings continue to decline, with just 5% expected by Week 26—marking the lowest level since March.

FEWB:

-

Capacity remains extremely tight, with blank sailings and reduced vessel sizes pushing utilization to maximum levels. Space is limited due to upcoming schedule changes, and rollovers are increasing. Carriers advise booking at least three weeks in advance to secure space.

TAWB:

-

Capacity availability has not changed significantly, but congestion at both Northern and Mediterranean ports continues to affect service reliability. Vessel frequency to Eastern Mediterranean ports remains below normal due to prior blank sailings and localized constraints.

-

Sources: xeneta.com, maersk.com, yangming.com, evergreen-line.com, supplychaindive.com

📌 Current U.S. Tariff Status (as of June 13, 2025)

President Trump announced a tentative trade agreement with China on June 11, proposing a 55% total tariff on Chinese goods entering the U.S. This is composed of:

-

10% IEEPA baseline reciprocal tariff

-

20% IEEPA “fentanyl-related” tariff

-

25% legacy tariffs imposed during Trump’s first term

China would impose a 10% total tariff on U.S. goods in return. The deal is pending formal approval from both President Trump and President Xi.

Separately, the U.S. Court of Appeals has kept existing IEEPA tariffs in place as legal proceedings continue, with oral arguments set for July 31. A 10% reciprocal tariff remains active for most countries through July 9, though Treasury officials suggest extensions are likely for key partners in ongoing trade talks. Goods of Chinese origin entering on or after May 14 are currently subject to the 10% rate through August 11, pending final implementation of the 55% terms.

Products listed in Annex II, along with semiconductors, remain exempt from reciprocal tariffs regardless of origin.

Source: whitehouse.gov, politico.com, whitehouse.gov

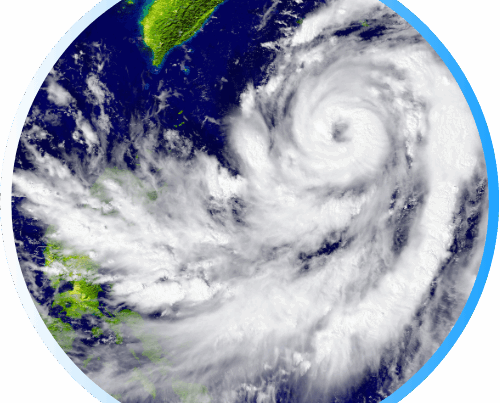

Storm Wutip Nears Southern China; Limited Port Impact Expected

Tropical Storm Wutip, the first named storm of 2025 for China, is approaching the southern coast after bringing strong winds and heavy rainfall to Hainan Island. Thousands were evacuated and transportation was disrupted in Sanya. The storm is expected to make landfall around noon on June 14 near the Guangdong–Guangxi border. As of now, Yantian Port in Shenzhen has paused empty container pickups from midnight to noon on June 14, with normal operations expected to resume later that day. in the afternoon

Shipping Risks Rise in Middle East Following Israeli Strikes on Iran

Tensions in the Middle East are increasing after Israeli military actions targeting Iran’s leadership, raising concerns about potential disruptions to container shipping through the Strait of Hormuz. While commercial vessels are not currently being targeted, regional instability has prompted warnings of escalation. Any closure of Hormuz could significantly affect Gulf ports and transshipment hubs like Dubai and Abu Dhabi, potentially leading to rerouting, port congestion, and higher freight rates.

US Trucking Rates Flat as Freight Demand Remains Soft

Recent data from the Cass Freight Index and US government price indexes show that freight volumes in the U.S. are declining, with May shipments falling 0.4% from April and 4% year-over-year. The data reflects weaker demand in both truckload and intermodal transport. This trend has stalled momentum for rate increases across the sector, despite cautious optimism among trucking executives about a market rebound in the months ahead.